Cold Outreach to Crypto Projects: Diagnose and Fix Your Funnel

Note: This guide is for agencies and service providers selling services to crypto projects. It is not a guide for token issuers looking for investors or token buyers.

You do not need another template dump. You need to find which stage of your outbound funnel is failing, then fix that stage first.

- Funnel map: 5 stages from list to meeting

- Troubleshooting table: symptom to cause to fix

- Fast audit: the 30-minute diagnostic checklist

- Damage control: when to stop sending

Crypto teams are scam-sensitive by default. When outreach underperforms, most agencies try to fix it by writing louder copy or adding more volume.

Both moves usually make things worse.

This page is intentionally narrow. It is a troubleshooting playbook for teams already sending outreach. If you need the full cold email protocol, use the step-by-step guide on cold email to crypto projects for service providers. Before digging into diagnosis, run the pre-flight checklist for cold lead gen in crypto so list, deliverability, and offer are validated.

Who this is for

- Agencies already running outbound to crypto projects, but the metrics look weak.

- Operators seeing bounces, low opens, or opens with no replies.

- Sellers who want a fast audit path, not a new channel strategy.

Not for token issuers trying to raise money, find exchange buyers, or drive retail demand.

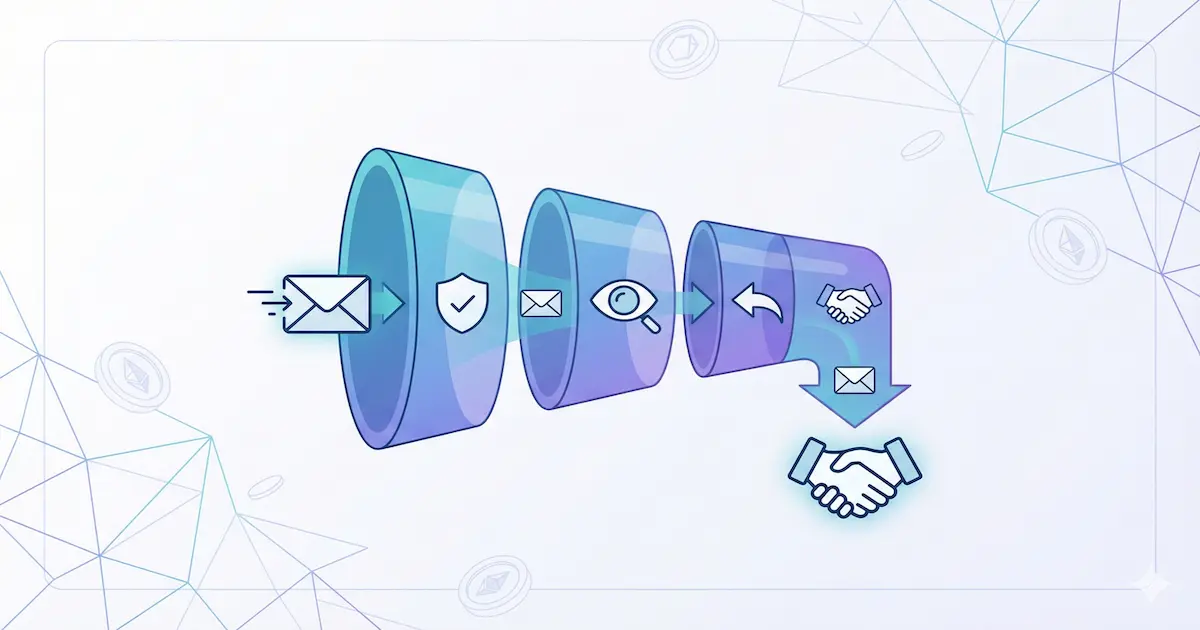

The funnel map (5 stages)

If you diagnose the wrong stage, you fix the wrong thing. Use this map to localize the problem before you rewrite copy or buy more leads.

| Stage | What can break | What you see | Fix direction |

|---|---|---|---|

| 1) List quality | Wrong fit or stale contacts | Bounces, spam complaints, angry replies | Narrow ICP, refresh sources, dedupe |

| 2) Deliverability | Domain or mailbox reputation issues | Emails land in spam or promotions | Pause, audit auth, slow down |

| 3) Open + read | Subject line and first line do not feel safe | Low opens, quick deletes | Make it boring, specific, human |

| 4) Reply | Offer and CTA feel risky | Opens but silence | Use micro-commitment, add proof |

| 5) Meeting booked | Reply handling and scheduling friction | Replies but no calls booked | Tight SLA, reduce meeting friction |

Copy cannot rescue a deliverability problem.

If Stage 2 is failing, pause and fix inbox placement before you rewrite the sequence.

Stage 1, list quality

List quality is not just “does the email exist”. It is fit, freshness, and context.

A simple way to audit list quality is to sample a handful of rows and ask:

- Project activity, does it still look active?

- Buyer role, does the contact match the person who buys your service?

- Website quality, does the site look real, or does it look like a copy-paste launch?

A 60-second lead check you can do before sending:

- Website, does

{website}load and show a real product? - Token URL, is

{tokenUrl}active and not a dead listing? - Context, does the contact clearly tie to the team, not a random inbox?

Stop there. The goal is speed and safety, not perfect research.

Mid-funnel CTA, if you want to test your workflow with real contact data: start with one free lead, then run the checklist below on that small sample before you scale.

Stage 2, deliverability

If inbox placement is unstable, do not “power through”. You are training providers to distrust you.

Use your deliverability checklist as a technical reference (authentication, sending posture, and inbox placement).

Stage 3, open and read

In crypto, founders filter for safety before relevance.

Your job is to look like a real operator with a real reason to email, then earn 10 seconds of attention.

Here is a quick subject line rewrite table you can use when opens are low.

| Risky subject line | Safer subject line | Why it works |

|---|---|---|

| Partnership opportunity | {tokenName} ops question | Sounds specific and non-promotional |

| Guaranteed growth | Quick question about {tokenSymbol} retention | Replaces hype with an operational topic |

| Question for CEO | Who owns {tokenName} listings? | Routes to the right owner and reduces sales pressure |

| Marketing proposal | One issue I noticed on {website} | Signals relevance without sounding like a pitch |

Stage 4, reply

Most campaigns die here. The email is opened, maybe even read, but the ask feels like a trap.

Instead of “Can you do a 30-minute call?”, test a micro-commitment:

- “Want me to send a 1-page checklist for

{tokenName}?” - “Should I share a quick teardown of the

{website}onboarding flow?”

Stage 5, meeting booked

A reply is not a win if it sits unanswered for a day.

Treat reply handling like ops. Set a response SLA, define next actions, and remove scheduling friction.

Symptom to cause to fix (table)

Use this table to jump from what you observe to what you should change.

| Symptom | Likely cause | Fix you can apply |

|---|---|---|

| High bounce rate | Stale or low-quality list | Stop the campaign, refresh data sources, reduce bounces with list validation, remove role emails and obvious junk |

| Opens drop suddenly | Reputation damage from volume spikes or bad segments | Pause sending, reduce volume, isolate the bad segment, then restart slowly |

| Low opens with low bounces | Subject line looks risky or irrelevant | Rewrite subject lines to be specific and boring, remove hype language |

| Opens but no replies | Offer is generic or the CTA is too big | Swap to a micro-commitment CTA, add one proof line, remove extra asks |

| Replies are mostly “not us” | Wrong persona or wrong contact point | Change targeting to the buyer role, ask who owns the area, then route correctly |

| Replies are angry | ICP mismatch or spammy framing | Tighten segmentation, remove pressure words, add a clear opt-out line |

| Replies come in but meetings are not booked | Slow response time or scheduling friction | Add an SLA, use shorter time windows, offer 2 options instead of a calendar link |

| Meetings happen but no next step | Call agenda is unclear or proof is missing | Send a pre-call proof pack, end calls with a specific next action and owner |

Mini case example

We reviewed a campaign that had consistent opens but almost no replies. The copy was polite, but it opened with three sentences about the agency.

The fix was simple:

- Lead with a project-specific observation tied to a real operational risk.

- Replace the meeting ask with a micro-commitment.

- Add one trust line that clarified what the team does not do.

Outcome wise, nothing was magic. We simply removed reasons to ignore the email.

The 30-minute diagnostic checklist

Run this before you change your offer, rewrite your entire sequence, or spin up new domains.

- Pull the last campaign report and write down what is failing first (bounces, opens, replies, or meetings).

- Sample recent leads and confirm fit, freshness, and basic legitimacy signals.

- Review deliverability basics and verify authentication and sending posture.

- Re-read the first email as if you are the recipient, then cut anything that feels like fluff.

- Check the CTA for risk, then replace it with a micro-commitment if needed.

- Inspect reply handling, routing, and time-to-first-response.

If your team wants a deeper ops checklist and benchmark guidance for scale, use crypto cold email outreach best practices for agencies. For a stage-by-stage metrics view and experiment backlog you can run by constraint, use the pipeline bottleneck and metrics guide for crypto client acquisition.

LeadGenCrypto • Updates

Get sharper at selling into token teams

Short, tactical emails for people doing B2B outreach to crypto projects. Learn what to change, what to test, and what to stop doing when replies go quiet.

- Quick breakdowns of new posts, so you can skim and move on

- Practical outreach tweaks that improve opens, replies, and booked calls

- Templates, proof lines, and “what to say next” scripts you can paste

- No noise, plain language, clear constraints, unsubscribe anytime

Quick fixes you can ship this week

Each fix is tied to a specific failure mode. Pick one or two, ship them, then re-measure.

- Pause sending for a day and run a deliverability audit before you touch copy.

- Trim the list to one tight segment so you can isolate fit problems quickly.

- Rewrite the subject line to be specific and low-pressure, not clever.

- Replace the meeting ask with a micro-commitment that feels safe.

- Add one trust line that removes scam fear and clarifies constraints.

- Tighten follow-ups so each touch adds value, not urgency.

- Set a reply SLA so interested replies get a fast human response.

When to stop sending (protect domain reputation)

If you keep sending through these signals, you can damage a domain that was previously healthy.

For the technical audit path, use the deliverability pillar: email deliverability for crypto outreach, SPF DKIM DMARC.

Stop sending if:

- Bounces spike suddenly compared to your normal baseline.

- Inbox placement shifts and real contacts say the message landed in spam.

- Complaints, angry replies, or unsubscribes jump after a new segment upload.

- Volume ramps too fast for your domain and mailbox age.

Where LeadGenCrypto fits

LeadGenCrypto is useful when your diagnosis points to list quality and list decay.

It can help you:

- Test outreach on fresh verified crypto project contacts instead of scraped databases.

- Filter leads by blockchain network so your message stays consistent within a segment.

- Avoid duplicates by uploading email or token URL exceptions.

- Export to CSV, or automate intake with the Public API.

End CTA, if you want automated routing into your CRM or outbound tools, use the Public API docs.