New Token Projects Launched per Month (by Chain) + Interactive Dashboard

If you sell services to token-based crypto projects, timing is everything. New projects buy audits, listings, liquidity, marketing, dev, compliance, and tooling right after launch. Miss the window and a competitor gets the budget.

LeadGenCrypto's Crypto Launch Barometer tracks verified token-based project launches by chain (not meme-coin noise). Coverage starts December 2020 and updates monthly.

Last updated: 1 Feb 2026 (includes launches through January 2026).

Public preview vs private dashboard

- On this page you get public preview charts, with the most recent months hidden.

- Unlock the private dashboard to see the latest months, apply filters, and export snapshots (plus the new "Other" breakdown chart).

Want the live, interactive view? Jump here: Get the private dashboard link.

Quick Highlights: Oct 2025 to Jan 2026

The last four months show a clear year-end dip and a partial January rebound. October and November stay relatively strong, December drops hard, and January climbs back but does not fully return to the Oct-Nov pace. Chains move in different directions: Solana and Ethereum gain ground, while Base and BSC lose momentum and the long tail tightens.

Here are three takeaways. Exact counts for the latest months and full chain splits are inside the dashboard.

- Solana stays on top and snaps back in January. It leads launches each month, dips in December, then rebounds sharply in January (roughly +25% month on month). Builders still treat Solana as the default launchpad.

- Ethereum posts its strongest month in January. After a weak December, Ethereum surges and retakes attention as a core deployment target while some L2 activity softens.

- Base and BSC cool off, and the long tail shrinks. Base declines month after month in this window, BSC drops steeply into December, and the "Other" bucket contracts. Activity concentrates on fewer major chains, with Solana and Ethereum as the main beneficiaries.

Now see the exact numbers and chain mix: Unlock the live dashboard.

Private access

Get the Private Dashboard Link (10 seconds)

Enter your work email and get an instant, private link to the interactive dashboard (updated monthly). You will unlock:

- Latest months that are hidden in the public preview

- Filters by chain, mode toggles, and snapshot exports

- The new "Other chains breakdown" chart that expands the Other bucket into individual networks

How to Read the Interactive Launch Dashboard and Turn the Numbers into Revenue

Tip: Click any legend label to hide or reveal a chain. The chart recalculates instantly so you can focus on only the ecosystems that matter to you.

What is inside the dashboard: 4 charts

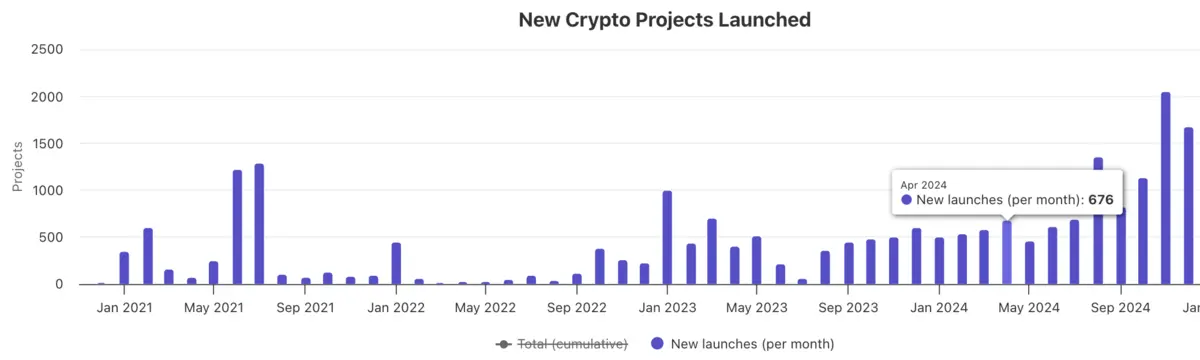

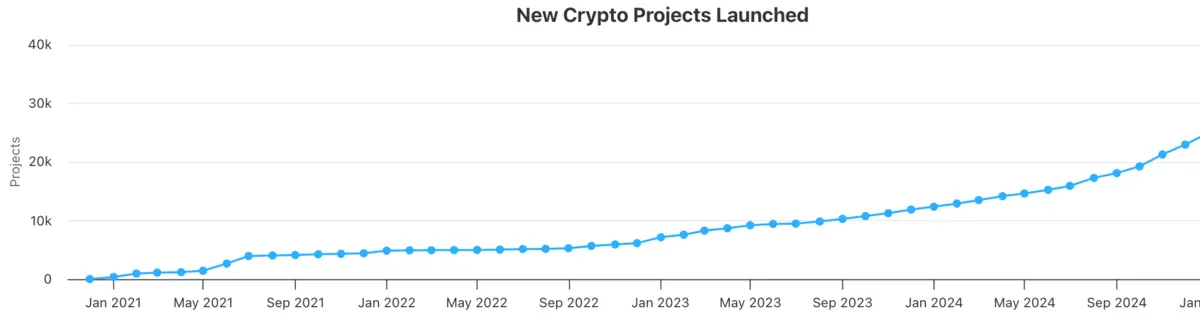

- New Token Projects Launched (monthly) - bar and line modes with date slider

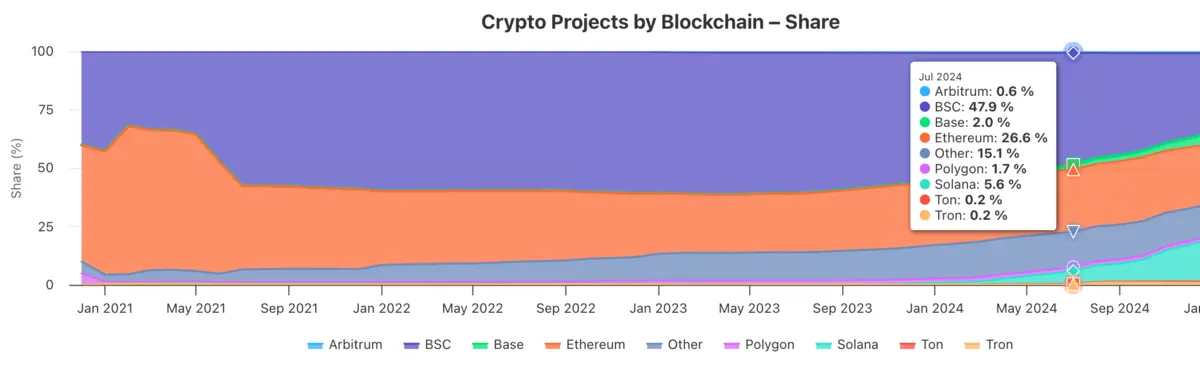

- Projects by Blockchain - Share - stacked percent view (always totals 100%)

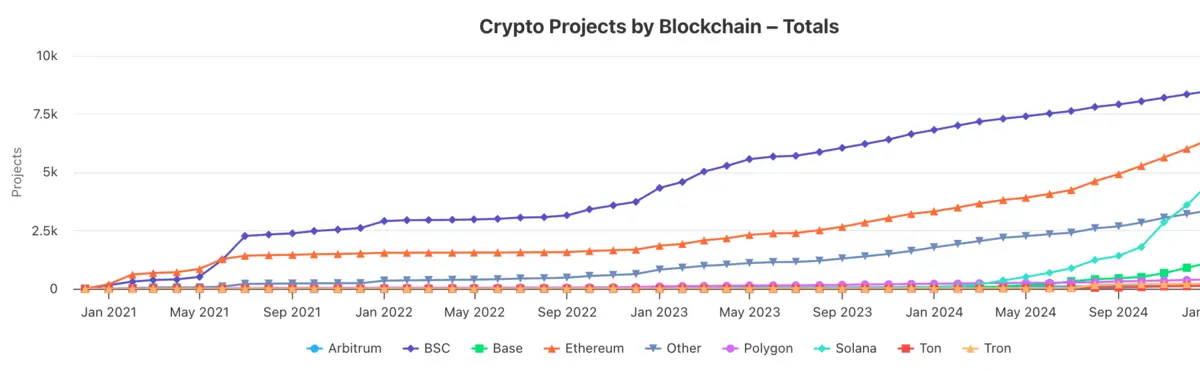

- Projects by Blockchain - Totals - cumulative lines (TAM by chain)

- Other Chains Breakdown - expands the "Other" bucket into individual chains so you can see which long-tail networks actually drive the totals

1) New Token Projects Launched: two insight modes

a) Monthly bar view

A listings sales manager (exchange, launchpad, coin tracker, listing agency) compares internal outreach volume against real launch volume. If your team contacted 100 prospects in a month but 600+ projects launched, you are under-covered. That gap is your missed revenue.

b) Cumulative line view

Toggle the cumulative line to show long-term market expansion. Founders use this to justify hiring, SDR headcount, or new vertical plays.

2) Projects by Blockchain: Share percentage

Hover any month to see the chain split (always totals 100%). Use this to decide where to focus outreach next month.

| Your question | Dashboard move | Resulting insight |

|---|---|---|

| Should we double down on Solana? | Check the latest month, then compare vs 3 months ago. | You see if momentum is real or fading. |

| Who is losing steam? | Watch any chain's share shrink 3 months in a row. | You can reallocate sales time early. |

3) Projects by Blockchain: Cumulative totals

This "league table" helps you size TAM for any chain and see which ecosystems are compounding fastest.

4) Other Chains Breakdown

In the first three charts, blockchains outside the top 8 (Arbitrum, BSC, Base, Ethereum, Polygon, Solana, TON, Tron) are grouped into a single bucket called Other.

The fourth chart expands Other into individual chains so you can see:

- which long-tail networks contribute the most projects,

- how the composition shifts month to month,

- where the Other totals come from in the Share and Totals charts.

Workflow checklist (how revenue teams use this)

- Scan monthly launches to spot fresh waves you can prospect this week.

- Check chain share to confirm whether the wave is chain-specific.

- Verify cumulative totals to confirm the ecosystem is big enough for a sales sprint.

- Use the Other breakdown to catch emerging chains before they show up as "top 8".

- Execute: pull contacts from LeadGenCrypto, load your CRM, and run outreach.

Want the latest months and the interactive filters? Get the private dashboard link

Why this data matters for crypto service providers

| Benefit | Why it helps you sell more |

|---|---|

| Marketing budget timing | Catch launch waves while projects still spend. |

| Chain prioritisation | Focus outreach where launch volume accelerates. |

| Market-size planning | Quantify TAM before you invest in a new product line. |

| Prospect-coverage benchmark | Compare your outreach volume vs real launches. |

| Ops and hiring forecasts | Scale your team with actual market activity. |

| Proof for clients and investors | Back proposals with transparent launch data. |

Why our dataset beats popular coin trackers

Before comparing dashboards, ask: does the data match your sales reality?

Popular trackers often count every contract deployment. Service budgets sit inside far fewer real teams. We built this dataset for revenue teams first.

- Longer history: our series begins Dec 2020 and updates monthly.

- Project-level focus: we track only teams capable of buying services.

- Duplicate control: we consolidate duplicates so one project equals one entry.

- Meme-coin noise removed: thousands of one-day rugs do not buy services, so we exclude them.

Get Access to the Full Interactive Dashboard

Full access

Unlock the Live Interactive Dashboard

Fill in your work email and get an instant, private link to the live dashboard. It is updated monthly and currently includes data through January 2026.

- View every month up to the current date

- Filter by blockchain, compare YoY shifts, download snapshot images

- Includes the new Other chains breakdown chart

Related guides

- Ultimate guide to crypto B2B lead generation

- Turn CoinMarketCap new listings into an outreach list

- Turn CoinGecko discovery views into an outreach list

- CRYPTO-10 outreach tactics

- Email deliverability (SPF, DKIM, DMARC)

LeadGenCrypto • Blog & Newsletter

Stay sharp: updates and sales plays in your inbox

Get timely updates, practical sales advice, and useful resources for teams selling services to crypto projects. Delivered straight to your inbox, no hype.

- Quick summaries of our latest articles so you can skim in minutes

- Actionable ideas to boost sales and fill your pipeline

- Handy resources (templates, checklists, chain-specific tips) you can use this week

- One-click unsubscribe anytime. We keep it useful, not noisy.

Conclusion

The market does not pause. Launch volume shifts chain by chain, month by month. If you sell services to token projects, this dashboard lets you time outreach while budgets are still available.

If you want the newest months, filters, exports, and the Other breakdown chart, grab the private link here: Unlock the live dashboard.