Crypto B2B Lead Generation for Service Providers: Ultimate Guide

Note: This guide is for agencies and service providers selling services to crypto projects. It is not a guide for token issuers looking for investors or token buyers.

Crypto founders get flooded with generic outreach, and most of it feels risky. The teams that consistently book calls earn trust fast, and they run a repeatable system from sourcing to follow-up.

Anti-overlap rule: This page stays intentionally high-level. Each step links to a dedicated deep dive so you can execute without rereading the same advice across multiple posts.

Want to test with real data first? Start with one verified contact record using the Get a free lead.

In this guide, you will:

- Define an ICP that matches your offer, chain focus, and timing window.

- Source fresh projects from listings, on-chain signals, and verified contact workflows.

- Send trust-first outreach that protects deliverability and stays compliant.

- Convert replies into calls with nurture sequences and simple CRM operations.

LeadGenCrypto • Briefings and field notes

Stay ahead of crypto B2B lead generation

Join practical updates for teams that sell services to crypto projects. Learn how to source better projects, protect deliverability, and turn replies into booked calls.

- Concise summaries of new playbooks and articles you might have missed

- Step-by-step outbound and nurture ideas you can test in your next campaign

- Worksheets, templates, and API use cases to plug into your existing stack

- No hype, no token picks, only B2B workflows for agencies and service providers

Who this is for (and not for)

This guide is built for:

- Agencies selling marketing, PR, SEO, content, community, or growth services to crypto teams.

- Providers selling audits, dev, tooling, listings support, or other B2B services to token projects.

- Operators building an outbound pipeline that can run through bull and bear markets.

This guide is not for:

- Token issuers trying to find investors or token buyers.

- Teams looking for retail customer acquisition tactics (this page is about B2B services).

When we say "lead generation" here, we mean: finding the right crypto projects and decision makers to contact about your service, then converting them into meetings and retained work.

The crypto buyer reality

Crypto decision makers ignore generic pitches for predictable reasons:

- Volume is high, founders get hit on email, Telegram, and X daily.

- Trust is fragile, scams and impersonation are common.

- Buying moments are short, timing matters more than most niches.

What tends to work instead:

- Relevance, show you understand the chain, stage, and context.

- Proof, include a simple "reason to believe" that reduces scam fear.

- Clarity, one offer, one outcome, one next step.

- A micro-yes CTA, ask for a low-friction reply before you ask for a call.

Step 1. Choose a narrow ICP and offer

Your fastest path to consistent replies is focus.

A practical ICP for Web3 services usually has four layers:

- Service fit, the project actually needs what you sell.

- Chain fit, your offer matches an ecosystem you understand.

- Timing fit, you can point to a real trigger or buying moment.

- Budget and intent fit, there is a real team behind the project.

If you need a structured worksheet, start with the ICP guide for selling services to crypto startups. For a breakdown of what token projects buy and when by lifecycle stage, see the positioning guide on services for crypto projects.

Step 2. Source fresh projects (3 main methods)

Most outreach underperforms because the list is stale, mismatched, or missing the right contact roles. Before you scale sending, fix sourcing.

To understand why lists decay in crypto, read why static crypto contact databases fail. To model cost per meeting and compare sourcing options, see the real prices and ROI guide for crypto outreach.

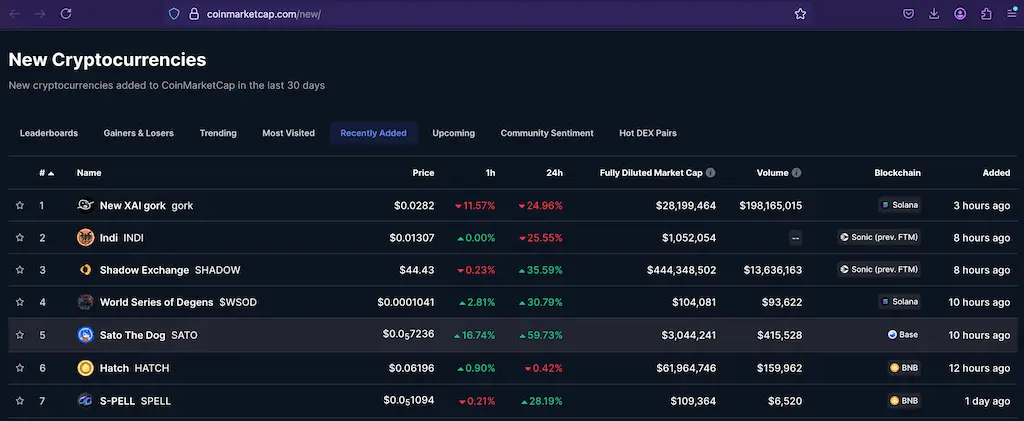

Method 1: CoinMarketCap discovery and tracking

CoinMarketCap is useful when you want a steady stream of newly listed projects, plus a consistent place to validate basics.

Start with the CoinMarketCap "Recently Added" listings page and then follow the workflow in our CoinMarketCap sourcing guide for service providers.

If you need programmatic access for research, CoinMarketCap also maintains the CoinMarketCap API documentation.

Method 2: CoinGecko discovery and tagging

CoinGecko can be helpful for alternative discovery views, and for cross-checking project metadata.

Follow the step-by-step CoinGecko sourcing workflow to find projects to pitch your services.

If you are building internal tooling, reference the CoinGecko API introduction.

Method 3: On-chain sourcing with block explorers

On-chain signals can surface projects earlier than directories, but it is noisy. Treat explorers as discovery, then verify off-chain before you outreach.

For a practical workflow, use the BscScan prospecting funnel for outreach.

Step 3. Build an outreach system

Sourcing creates opportunity, but the system that converts is outreach plus follow-up.

Start with the pillar guide: cold email to crypto projects, step-by-step for service providers.

For quicker experiments, use the 10 cold outreach tactics for selling services to crypto projects and the crypto cold email best practices checklist.

A simple system to start with:

- Segmentation, split lists by chain and timing window so the message stays consistent.

- Research, collect two relevant facts and stop, do not write biographies.

- Message, use a short email with a clear reason you picked them and a micro-yes CTA.

- Sequencing, follow up with proof and a single next step, not pressure.

For a worked example with templates, cadence, and revenue outcomes, see the PR agency outreach case study.

Step 4. Deliverability and compliance

In crypto, deliverability and trust are inseparable. If your email does not land in the primary inbox, your copy does not matter.

For setup and testing, follow email deliverability for crypto outreach: SPF, DKIM, and DMARC.

For compliance basics, read is buying crypto B2B leads legal, a practical guide for service providers.

A safe baseline:

- Authentication, SPF and DKIM aligned, DMARC in place.

- Opt-out handling, honor requests and maintain suppression lists.

- Honest positioning, avoid hype claims and misleading promises.

- List hygiene, dedupe before sending to reduce complaints.

Step 5. Nurture and convert

Most B2B deals in Web3 close after multiple touches. The goal is to turn a first reply into a booked call, then into a scoped project.

For chain-based segmentation and longer follow-up, use the multi-chain nurture playbook for converting outreach into deals.

For reply handling, objections, and follow-up templates, see crypto email marketing sequences for B2B deals.

Step 6. Automate operations

Once your system works in small tests, automation keeps it from breaking at scale.

Two pages to anchor your ops:

- Lead intake and routing, see lead streaming and a crypto project contacts API.

- Sales process and follow-up stages, use the CRM pipeline in six steps for selling to crypto projects.

For one playbook that connects discovery, CRM, outreach, and pipeline measurement, see the repeatable acquisition operating system for service providers.

Where LeadGenCrypto fits

LeadGenCrypto is designed to remove the list-building bottleneck for service providers, without turning outreach into spam.

In plain terms, it can help you:

- Get verified contact records delivered daily, including website, token address, blockchain, token name, token symbol, and verified email(s).

- Filter delivery by blockchain so you stay focused on the ecosystems you serve.

- Export contacts to CSV for simple workflows, or pull them via API for automation.

- Prevent duplicates using email and token URL exceptions (a suppression-style workflow).

If you want to start small, use the Get a free lead and build one clean micro-campaign first.

Choose your path

Not every team needs every step at once. Pick the track that matches where you are today.

- New to outreach: Start with the cold email step-by-step guide, then narrow your targeting using the ICP worksheet.

- Small agency or solo: Use the small-agency strategy for crypto client acquisition as a high-level hub and resource picker.

- Outreach and content running but not compounding: Use the outbound-inbound flywheel framework to connect proof, outreach, and distribution.

- Scaling a working campaign: Re-check deliverability setup and move to lead streaming via CSV or API to keep lists fresh.

- Troubleshooting low replies: Use the cold outreach funnel diagnosis guide to find the real bottleneck before you change copy.

- Pipeline running but underperforming: Use the metrics-based bottleneck guide for crypto client acquisition to diagnose weak stages and run targeted experiments.

Stage-to-guide map

| Stage | What to focus on | Best article to read next |

|---|---|---|

| ICP and segmentation | Choose chain, stage, buyer role, and triggers | Build an ideal customer profile for crypto startups |

| List quality | Avoid stale data, duplicates, and wrong-fit contacts | Verified crypto project contact emails, why static databases fail |

| CoinMarketCap sourcing | Build a watchlist from new listings | Find projects on CoinMarketCap to pitch your services |

| CoinGecko sourcing | Discover projects through alternative views | Find projects on CoinGecko to pitch your services |

| On-chain sourcing | Use explorer signals for earlier discovery | Find token projects on BscScan, a 3-stage outreach funnel |

| First outreach test | Write a trust-first email sequence | Cold email to crypto projects, step-by-step |

| Deliverability readiness | Authenticate, warm up, and protect sender reputation | Master email deliverability for crypto outreach |

| Nurture and follow-up | Convert replies into booked meetings | Multi-chain email nurture playbook |

| Automation and intake | Stream contacts and route without duplicates | Crypto lead generation streaming and contacts API |

| CRM pipeline | Track stages from reply to close | Automate your sales process in six steps |

Appendix: Sample cold email skeleton

This is a minimal, crypto-safe starting point. For a complete protocol and sequence timing, use the cold email step-by-step guide.

Subject: Quick idea for `{tokenName}` on `{blockchain}`

Hi `{tokenName}` team,

I was on `{website}` and also saw the token page at `{tokenUrl}`. One thing stood out that might matter for your next growth push.

I run a small team that helps crypto projects with (your service). If it is useful, I can send 2 to 3 specific ideas based on `{blockchain}` and your current positioning.

Open to a quick reply with "send it" and I will keep it short.

Best,

(Your name)

(Your company)

Want to automate lead intake after your first tests? Use the Public API. If you run an AI agent (e.g. OpenClaw), see connect your agent to LeadGenCrypto.